Project Finance 101 Webinar

Are you new to renewable energy project financing? We put together a webinar that’s a 101 guide for asset managers to get familiar with the world of project financing. Industry expert John Harney, VP of Financial Products & Services at SkySpecs, breaks down the basics of project finance, the terminology you need to know, common […]

Containing O&M Wind Costs in European Asset Management

Portfolio management can help hedge against challenges Authors: Ray O’Neill and John Harney As global pressure mounts to accelerate the build-out of renewable energy, some new challenges are starting to appear. Inflation, greenflation, supply chain issues and permitting are some of the trends that can be difficult to mitigate for portfolio owners. As […]

Lease Payments – Getting them right from the start

Now that the Renewable Electricity Support Scheme (RESS) is about to kick off and land options will be converting to leases we felt it was timely to get our perspective on land leases down on paper. This blog post is framed around the commercial questions that can often go unanswered but which can provide some […]

RESS-1 & Inflation, the Forgotten Sensitivity

RESS Auction – Strategy The Renewable Electricity Support Scheme (RESS) is designed to promote investment in renewable energy generation in Ireland. This competitive auction requires developers or operators to bid in at their required rate of return, and if successful will be paid in line with their bid. In most European markets, similar renewable energy […]

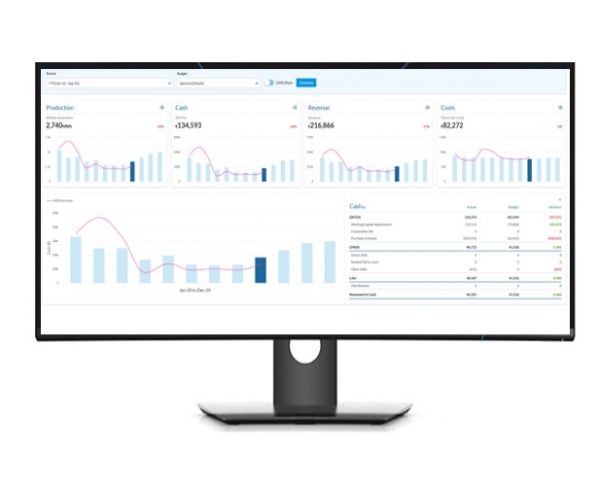

Do you want to grow AUM?

Managing the financial, compliance and regulatory risks across a growing portfolio is getting more and more complex with the exposure to errors, that lead to a reduction in investor confidence and higher costs of capital, increasing all the time. At SkySpecs we see that the successful asset managers and fund administrators use financial administration, risk […]

Is there a new investor in town?

Covid Investors Covid Investors, a rather new term, are people who have capital to invest and have been awoken by the Covid-19 global crisis to the power of externalities like viruses but also climate change. People are seeing the damage caused firsthand and the penny has dropped that if you wait until you can feel […]

What differentiates a top quartile renewable energy asset manager/fund?

Renewable energy asset performance management is maturing as the industry develops with yield/returns top of everyone’s mind. Every asset manager and fund manager in the sector is striving to grow their assets under management (AuM) by raising more funds an acquiring more assets. The difference between the top quartile and the rest is related to […]

How to improve asset IRRs?

The job of any good asset owner or fund manager is to buy under-valued cash flows (i.e. the future income from a wind or solar farm) and enhance the income stream to improve the value/returns for investors. Let’s take a look at how this can be achieved. Activity Reduce asset financial admin costs Each SPVs […]

Spreadsheets. The industry’s dirty little secret

Barclays Capital accidentally bought an extra 179 assets from Lehman Brothers, because excel rows were hidden instead of deleted. The humble spreadsheet can no longer be the “go-to” tool for the financial industry. Why? No Audit Trail Spreadsheets are a super flexible tool and extremely powerful. But they’re not ideal when looked at through the […]